The future of electric driving looks promising. EV adoption is accelerating across Europe, regulations are tightening, and tenants increasingly expect charging options. For property owners, the question is no longer if chargers will be needed, but how to add them.

The question can lead to a financial dilemma: should you invest in chargers yourself, or let someone else do it for you?

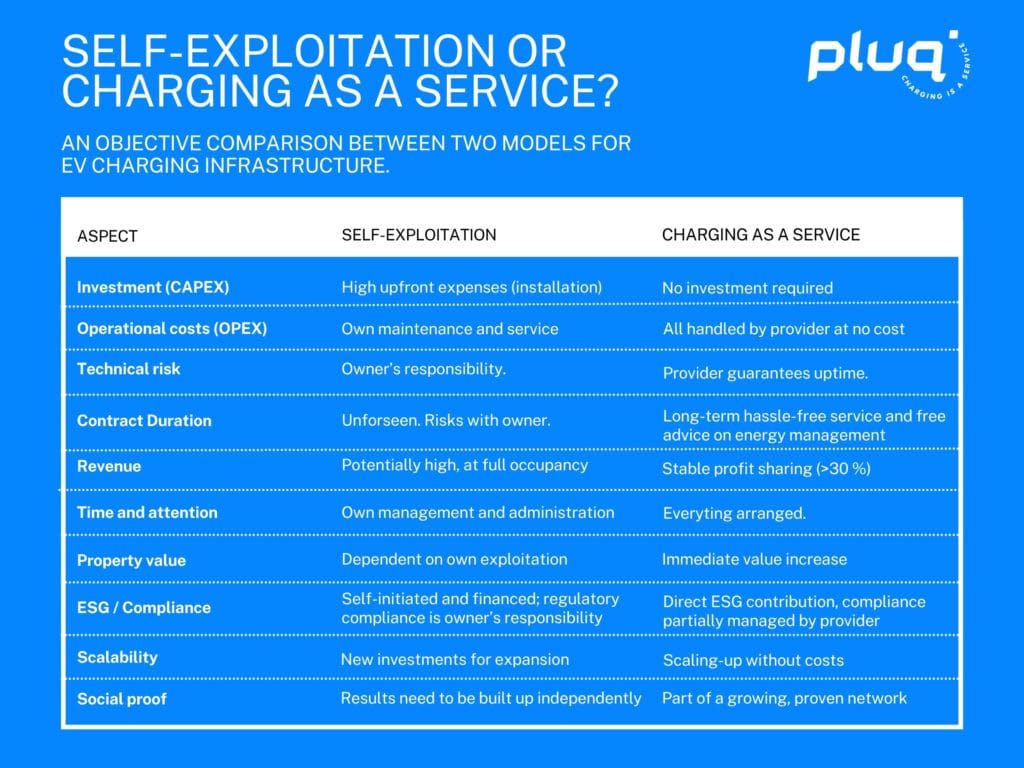

This article explores both sides of the equation. We’ll examine the real costs of EV charging, the risks associated with direct investment, and why Charging as a Service (CaaS) has become a compelling alternative for investors seeking to enhance property value without tying up capital.

The Real Costs of EV Charging Infrastructure

On paper, installing chargers may seem straightforward: buy the hardware, hire a contractor, and start billing EV drivers. But the accurate financial picture is more complex.

Upfront costs (CAPEX)

A single dual charger can cost between €3,000 and €5,000, depending on the brand and power rating. Add installation, cabling, trenching, and metering cabinets, and the real investment quickly rises to €6,000 or even €8,000 per charging station.

Grid connection and upgrades

Grid congestion is a growing issue in the Netherlands, France, Belgium, and Germany. Even if your site has capacity today, upgrades may be required tomorrow. These costs can dwarf the charger investment itself, running into tens of thousands of euros.

Ongoing costs (OPEX)

Chargers are not a one-time expense. Regular maintenance, software licenses, transaction fees, and remote monitoring add recurring costs. And if a charger fails, downtime can damage your reputation with tenants or guests.

Depreciation and obsolescence

Technology is evolving fast. Ultra-fast chargers, inductive charging pads, and even “charging while driving” pilots are underway. A charger installed in 2025 may be outdated by 2030. That means risk of stranded assets — infrastructure that no longer adds value.

For many property owners, this raises a tough question: Is this really the best use of my capital?

The Investor’s Dilemma: Control versus Risk

Owning chargers gives you control. You decide pricing, user access, and branding. In theory, you also capture 100% of the revenues.

But with that control comes risk:

- Utilization uncertainty: Will drivers actually use your chargers enough to deliver ROI?

- Technological risk: What if your chargers are outdated before they’re paid off?

- Operational risk: Who manages repairs, software updates, and billing disputes?

For investors, the key trade-off is clear:

- Self-investment = potentially higher returns, but also higher risk and complexity.

- Outsourcing (CaaS) = lower risk, no upfront costs, and an income stream that grows with usage.

Charging as a Service: No CAPEX, No OPEX

Charging as a Service (CaaS) is simple: instead of investing yourself, you partner with a provider like Pluq. We finance, install, and operate the chargers at zero cost to you.

Here’s how it works:

- We invest: All hardware, installation, grid work, and permits are covered by us.

- We operate: We take care of maintenance, troubleshooting, software, and billing.

- You earn: From day one, you receive a share of the charging revenues.

For property owners, this means no CAPEX, no OPEX, no hassle. You keep your capital free for projects with higher or more predictable returns — tenant improvements, ESG upgrades, or new developments — while still adding value to your property.

The Financial Upside of CaaS

The revenue from CaaS grows as usage grows. In the early years, income may be modest. But as EV adoption accelerates, utilization rates increase, and your passive income grows accordingly.

At the same time, your property benefits immediately:

- Higher rental yield: Tenants see EV charging as a premium amenity.

- ESG compliance: EU regulations require charging infrastructure in new and renovated buildings.

- Increased asset value: Independent studies show that green, future-ready buildings command higher valuations.

And unlike direct investment, there’s no risk of negative cash flow. You don’t spend thousands upfront, hoping for future payback. Instead, you start positively from day one.

But What About the Contract?

For many property owners, the most considerable hesitation isn’t money; it’s the contract. A 10-year agreement can feel like a lock-in.

But think of it differently:

- Ten years means ten years of guaranteed peace of mind.

- Ten years of professional maintenance and service at no cost.

- Ten years where your property remains future-ready, with chargers that keep working for tenants and guests.

And with flexible terms, evaluation moments, and transparent reporting, the contract is not a limitation but a guarantee: your site will be powered and maintained for the long run.

From Scepticism to Smart Investing

Many property owners are sceptical at first. Why share revenues when you could own 100%? Why commit to an extended contract?

But their experience tells a different story.

“I thought I’d lose returns by not investing myself. In practice, I gained a growing cash flow without spending a single euro. My building is more attractive to tenants, and I sleep better knowing I don’t have to manage the infrastructure.” – Commercial property investor, Belgium

These stories prove the point: true business insight can be about outsourcing risk wisely.

The Bottom Line for Real Estate Investors

EV adoption is accelerating. Tenants are asking for chargers. Regulations are tightening. The question isn’t whether EV charging will be necessary — it’s whether you want to pay for it yourself.

- If you invest directly: you may capture more revenue, but you also carry all the risk.

- If you choose CaaS: you outsource the risk, keep your capital free, and still earn from day one.

For forward-thinking property owners, Charging as a Service is more than an operational solution. It’s a financial strategy: add value, meet regulations, and generate income without touching your balance sheet.

Conclusion

Wise investors know that long-term success is not about jumping on every trend, but about allocating resources where they create the most value.

EV charging is essential, but that doesn’t mean you have to fund it yourself.